Exponential Growth in a Mortgage Brokerage: The Role of Referrals and External Marketing

- Adam Wyrill

- Sep 24, 2024

- 3 min read

When building a successful mortgage brokerage business, one key strategy is the ability to

leverage client referrals. Anecdotal evidence from personal experience shows that for every new mortgage client, a skilled broker can expect at least two referrals over the life of that first client relationship. This referral process creates exponential growth, as each new client generates additional referrals, who then generate even more referrals, causing rapid client base expansion.

In our own experience, having started, grown, and eventually sold a mortgage brokerage of 27 brokers to a PLC, this strategy played a crucial role. The power of referrals meant that as we secured new clients, they referred others, allowing the business to grow steadily.

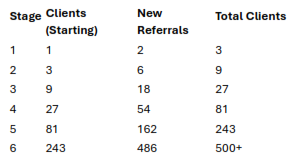

Table of Referrals Over Time

Below is a table that demonstrates how client numbers can grow exponentially when each new client refers two others during their life cycle. The table tracks growth until the total client base reaches 500:

Chart of Referral Growth

This chart illustrates how a single client generates new clients, and as the process repeats, the business grows exponentially. By the time we reach stage six, the total client count surpasses 500 due to the power of referrals.

This chart illustrates how a single client generates new clients, and as the process repeats, the business grows exponentially. By the time we reach stage six, the total client count surpasses 500 due to the power of referrals.

The Role of External Marketing in Generating Exponential Growth

In addition to organic client referral growth, external marketing plays a crucial role in powering

growth faster. Leads to mortgage brokerages not only generate immediate revenue but also sets the foundation for future additional referral-based growth.

The Importance of External Marketing

In our experience, for every pound spent on purchasing leads or external marketing, brokers can expect a £2 return. This direct return on investment (ROI) drives immediate revenue, but the benefits extend far beyond the initial transaction:

1. Immediate Revenue Generation: Each pound spent on leads generates £2 in revenue,

helping brokers build a client base and cover operating costs. This revenue can be

reinvested into marketing to create a sustainable flow of new clients.

2. Referral Growth: Each client generated through external marketing brings the potential

for two additional referrals over their life cycle, at no extra marketing cost. This amplifies

the value of each lead, creating a compounding effect on client growth.

3. Recruitment of New Brokers: As client numbers grow due to direct leads and referrals,

brokerages can recruit more mortgage brokers (fee earners) to manage the increasing

demand. This scalability is key to growth, but it is heavily dependent on a steady influx of

new clients from marketing efforts. Without a strong lead pipeline, recruiting more

brokers and scaling would be unsustainable.

The Growth Cycle

Here’s how the growth cycle works in practice:

Leads: External marketing generates new client leads.

Revenue: Each lead produces a twofold return on marketing spend.

Referrals: These clients generate additional business via referrals, at no extra cost.

Recruitment: As the client base grows, more brokers are brought on to manage the

workload.

Scaling: With more brokers and more clients, the business enters a self-sustaining

growth cycle.

Conclusion

While referral growth is key to long-term success, everything starts with marketing

investment. Without the leads provided by marketing, it would be difficult to establish the initial client base necessary to fuel the referral system. Over time, this balanced strategy of investing in marketing leads and leveraging referrals has proven essential for scaling successful mortgage brokerage businesses.

From our own experience, this combination of strategies allowed us to grow a mortgage

brokerage firm to 27 brokers before successfully selling it to a PLC. This demonstrates the

importance of external marketing in generating initial revenue, fostering referral growth, and

enabling business expansion through broker recruitment.

In short, to scale a mortgage brokerage, you need more leads first—and ongoing—before you

can recruit and scale effectively.

If you'd like to learn how our marketing and lead generation strategies can help grow your

business, get in touch with one of the team at DigiFin today!

Comments